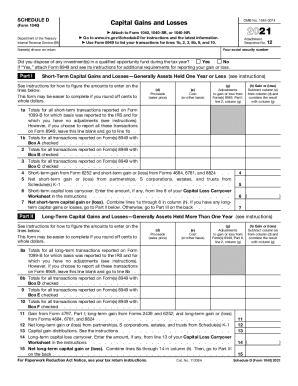

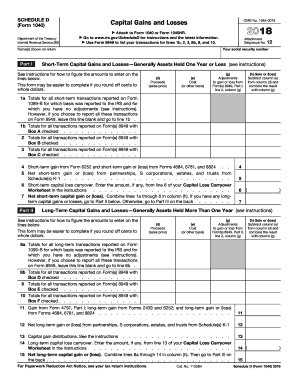

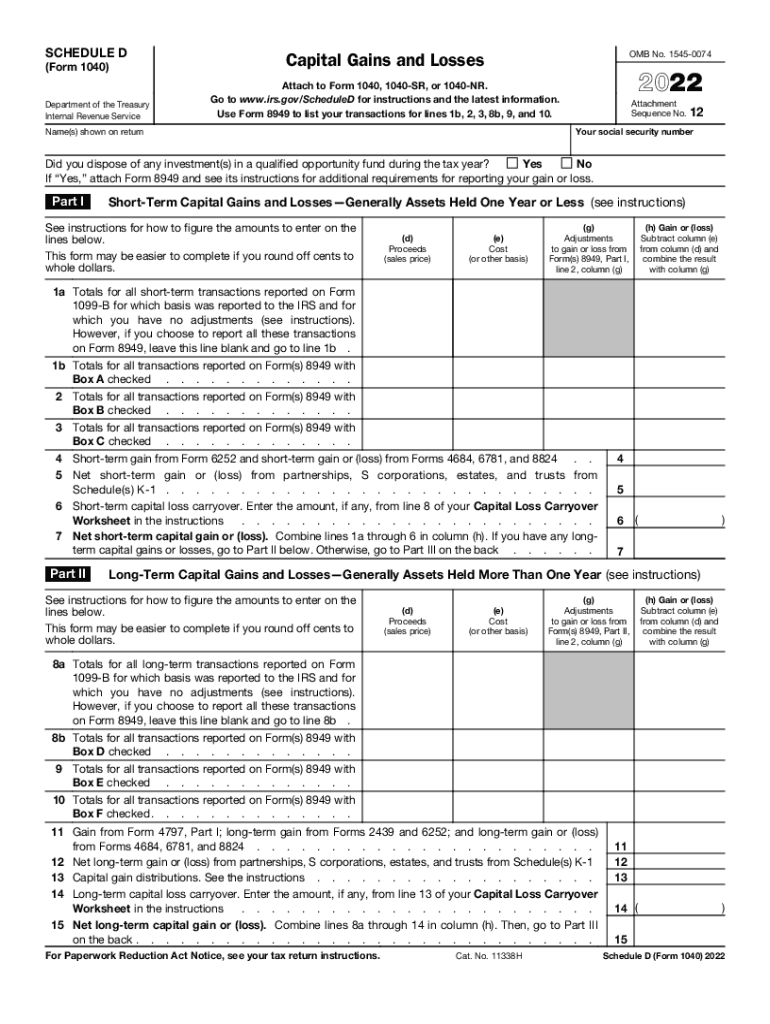

Form 1040 Schedule D 2024 Printable – What form is cost basis reported on? In either case, you must report your cost basis information to the IRS on Form 8949 and on Form 1040, Schedule D, for any shares sold Select the Custom tab in . Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print Schedule D form and attached to the 1040. .

Form 1040 Schedule D 2024 Printable

Source : www.uslegalforms.comU.S. Individual Income Tax Return Income

Source : www.irs.govSchedule D (Form 1041) 2023 Fill Online, Printable, Fillable

Source : form-1041-schedule-d.pdffiller.comIrs S 1040 Schedule D 2018 2024 Form Fill Out and Sign Printable

Source : www.signnow.comCapital Gains and Losses Schedule D (Form 1065) Fill Online

Source : 1065-d.pdffiller.comNew IRS Schedule D Tax Form Instructions and Printable Forms for

Source : kdvr.com2022 1040 schedule d: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2014 schedule d: Fill out & sign online | DocHub

Source : www.dochub.com2023 Schedule D (Form 1040)

Source : www.irs.govForm 1040 Schedule D 2024 Printable IRS 1040 Schedule D 2021 2024 Fill and Sign Printable Template : You come to a line on form 1040 that requires a supporting form or schedule, so you go there and Finally, you file your return electronically and print or otherwise save a copy for yourself. . In 2024, these limits increase to $47,025 for Taxpayers report capital gains on Form 1040, Schedule D and Form 8949. Payment can be made through estimated tax payments or when filing the .

]]>