Irs Form 1041 Schedule G 2024 Form – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . 2024. Late returns are accepted via e-file until November. “Understanding the estimated tax refund schedule, being aware of delays related to specific tax credits, and using efficient tax-filing .

Irs Form 1041 Schedule G 2024 Form

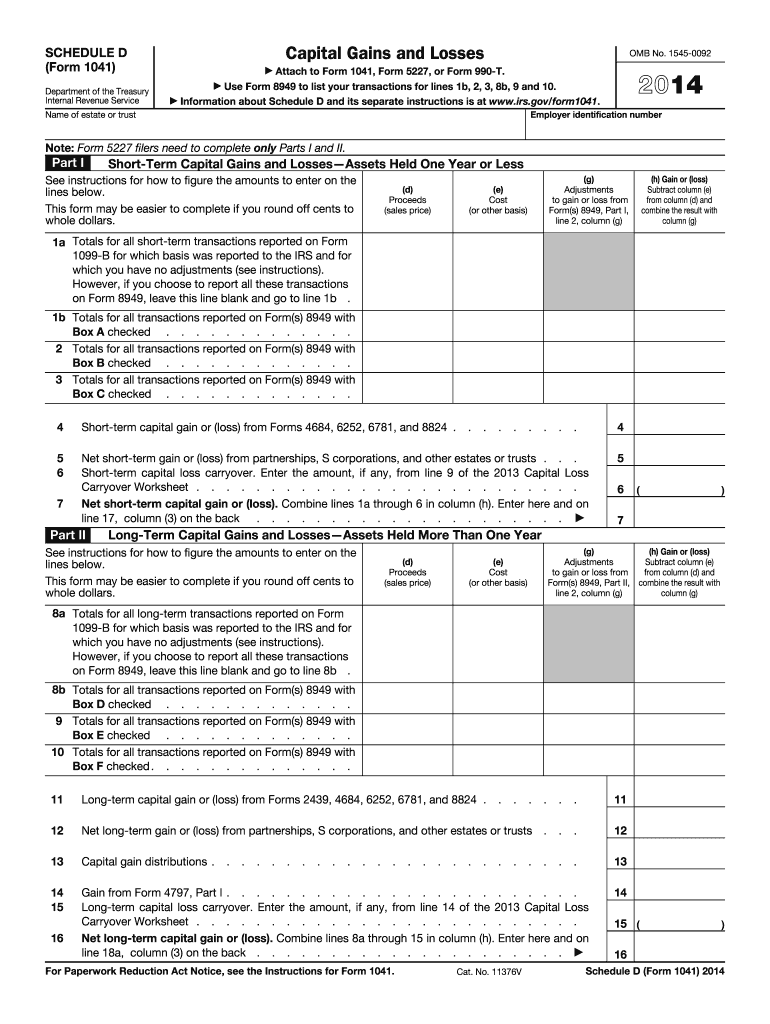

Source : form-1041-schedule-d.pdffiller.comInstructions for Form 1041 and Schedules A, B, G, J IRS Gov Fill

Source : www.signnow.comWhat Is IRS Form 1041?

Source : www.thebalancemoney.comIrs form 1041 schedule d: Fill out & sign online | DocHub

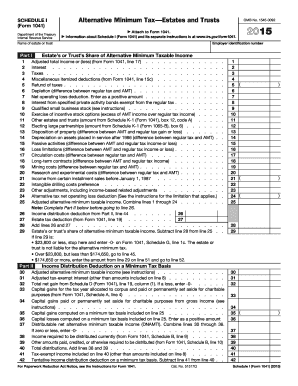

Source : www.dochub.comA 2024 Overview of IRS Form 1041 Schedules

Source : www.getcanopy.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

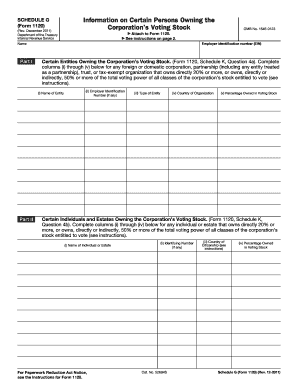

Source : www.irs.gov2011 2024 Form IRS 1120 Schedule G Fill Online, Printable

Source : 1120-schedule-g.pdffiller.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

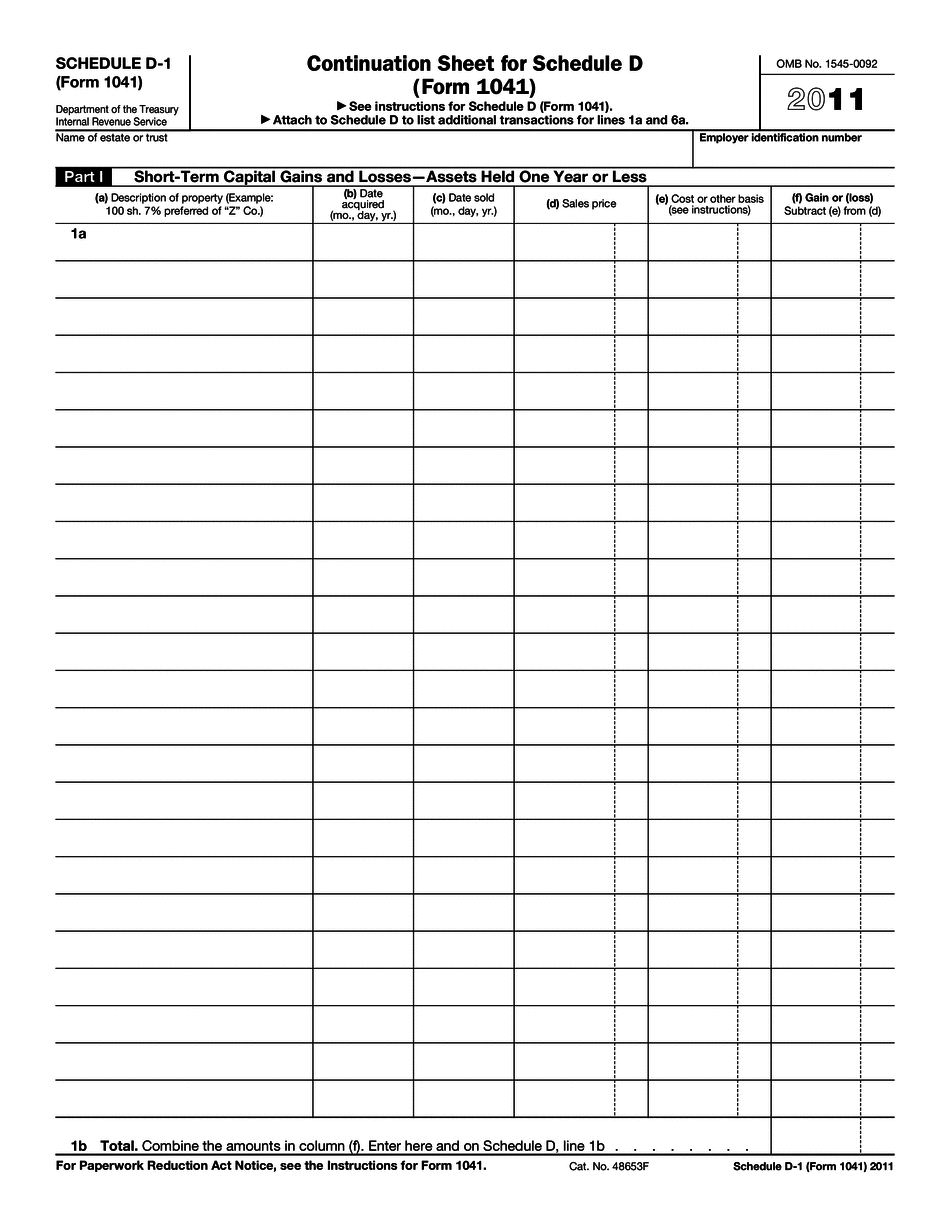

Source : www.irs.govSchedule D 1 (1041 form) | signNow

Source : www.signnow.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.govIrs Form 1041 Schedule G 2024 Form Schedule D (Form 1041) 2023 Fill Online, Printable, Fillable : I cover individual tax issues and IRS developments (the filing and payment deadline was not extended for Form 1120-C or for Form 1041) had been added to the list of undebited payments. . must submit formal periodic estimated payments to the IRS using Form 1040-ES for individuals and Form 1041-ES for estates and trusts. Form 1040-ES and Form 1041-ES Taxpayers making estimated .

]]>

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)